- #QUICKBOOKS ACCOUNTANT ONLINE PAYROLL LOGIN HOW TO#

- #QUICKBOOKS ACCOUNTANT ONLINE PAYROLL LOGIN UPDATE#

Once that is done select the pricing, add the payment option, and then checkout.Instead of signing in, click on the Signup option which you will see at the bottom of the form. On the homepage, you will see a sign-in option at the top of the Window.Visit the official website of QuickBooks.To sign up on the website, follow the steps given below. Signing up on QuickBooks is an easy process.

#QUICKBOOKS ACCOUNTANT ONLINE PAYROLL LOGIN HOW TO#

You will also learn how to use payments received on unpaid invoices so that your accounts receivable (A / R) are up-to-date and revenue can be calculated twice. By the end of this tutorial, you will be able to track your credit sales by creating and sending email invoices to your customers and recording cash sales in the absence of an invoice. There are two types of sales in QuickBooks: credit sales and cash sales. This tutorial includes how to record your sales and track your earnings in QuickBooks Online. What’s Covered in this tutorial : Quickbooks Online Login on Quickbooks accounting portal to manage the business financial report. Quickbooks login/ Sign in possible at as an Quickbooks online(QBO)/ self-employed/ Payroll/ Payments/ ProAdvisor Program/ Online Accountant/ Desktop Account, Intuit payroll etc. If you already have a QuickBooks Online account, here are some things you want to do next. If you do not yet have a subscription, work with your accountant to set up your account. To make sure you’re properly set up, follow these simple steps. QuickBooks helps you easily interact with your accountant anytime, anywhere to refresh your books.

Direct deposits for payroll can only be voided since action has taken place outside of QuickBooks Online.You may need an accountant, given the size and type of your business. Payroll checks that have been cashed are voided, but payroll checks that have n ot been cashed are deleted. Even Dawn Brolin would be thrilled to see us keep the transaction in QBO as a voided check, so later it could be viewed if necessary.īut when it comes to QuickBooks Online Payroll checks, here’s the deal with delete and void. This especially is true for payroll checks from an audit standpoint. This is great advice and best practice, because it enables you to preserve the audit log concerning the transaction. If you’re like me, you have the voice of “Murph ” in your head saying, "Don’t Delete, Void Instead." Plus, how fun is it to act like the magic wizard who whisks in and fixes stuff with a wave of the wand?

#QUICKBOOKS ACCOUNTANT ONLINE PAYROLL LOGIN UPDATE#

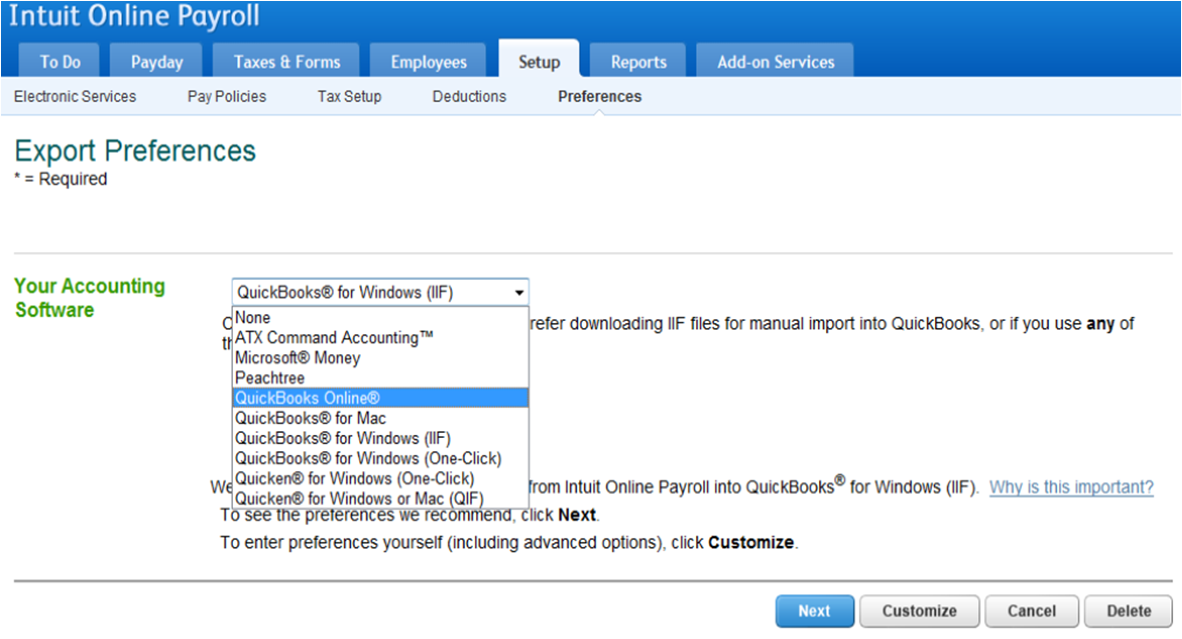

This is one update I’m keeping close to the vest, which will enable me to oversee that important details are not deleted unnecessarily. Honestly, I see this QuickBooks Online Payroll update as a feature designed for ProAdvisors, bookkeepers and accountants, because of the implications deleting paychecks has on payroll deposits and payroll reports. Our frustration was compounded if the whole payroll run needed to be voided. We either had to call Intuit Support for assistance or delete all prior paychecks in order to gain access to the one paycheck we needed to eliminate. Prior to this update, voiding and deleting checks from a payroll older than the last paycheck run was agonizing work because of the time consuming process. Now we can void or delete paychecks, regardless of the date the paycheck was created. I know we don’t like to, but sometimes it’s necessary to void or delete a paycheck. We don’t often get QuickBooks Online Payroll Updates, so this is exciting news.

0 kommentar(er)

0 kommentar(er)